FED NOTES: Originally published in the Spring 2021 edition of Bank Owner magazine.

By Mike Scott

In 2020, the Federal Reserve System revised its regulations related to determinations of whether a company has the ability to exercise a controlling influence over another company for purposes of the Bank Holding Company Act (BHC Act) or the Home Owners Loan Act (HOLA). This final rule was originally to become effective April 1, 2020, but the effective date was delayed until Sept. 30, 2020, to provide companies affected by the new control rule with additional time to analyze the impact of the rule on existing investments and relationships, and to consult with FRS staff as necessary.

By codifying presumptions of control in Regulation Y and Regulation LL, this rule provides bank holding companies, savings and loan holding companies, depository institutions, investors, and the public a better understanding of the facts and circumstances that the FRS considers most relevant when assessing control and thereby increases transparency. The complete final rule is available at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200130a.htm.

Under the BHC Act, a three-pronged test is used to determine whether a company has control over another company. Control exists if the first company (1) directly or indirectly or acting through one or more other persons owns, controls, or has the power to vote 25 percent or more of any class of voting securities of the other company; (2) controls in any manner the election of a majority of the directors or trustees of the other company; or (3) directly or indirectly exercises a controlling influence over the management or policies of the other company. HOLA has a substantially similar control definition.

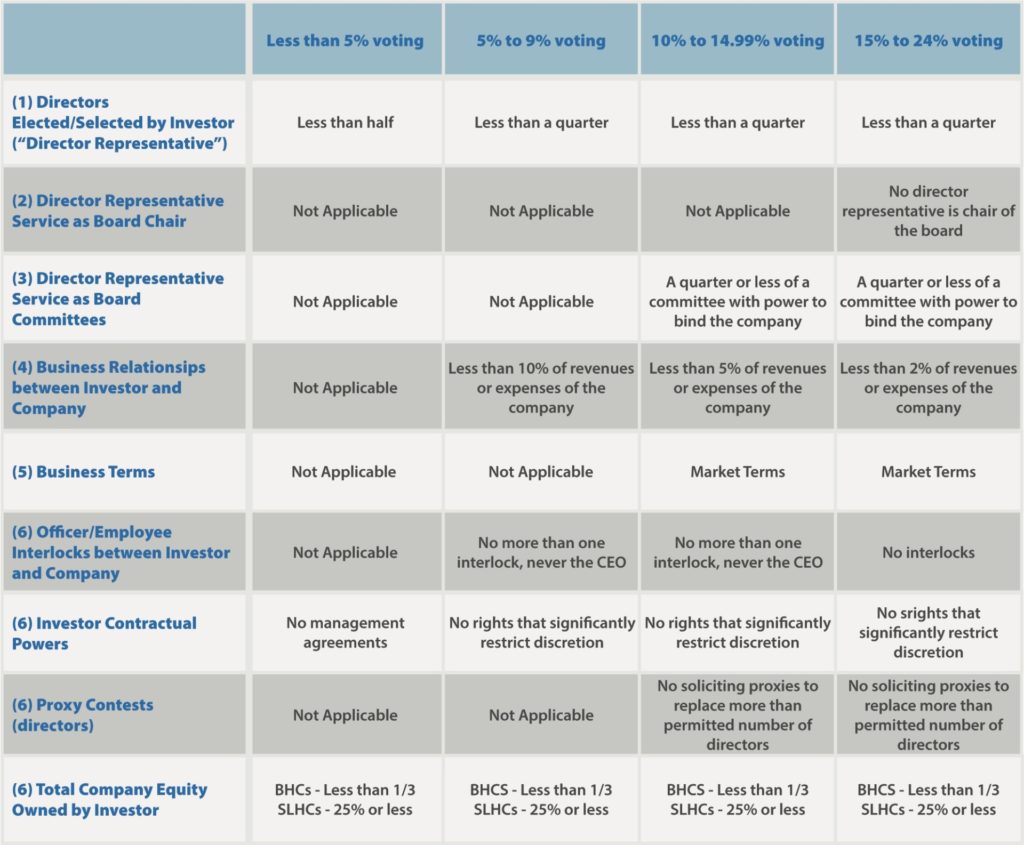

While the first two prongs are measurable standards that are easily understood, the third prong has historically required a situation-specific determination by FRS staff. To provide greater clarity regarding the third prong, the new control rule established nine objective factors and four ownership thresholds that help indicate whether an investor has the ability to exercise a controlling influence over a company. The table below contains these nine factors (column 1) and four ownership percentage ranges (row 1). An investor is presumed to exercise a controlling influence over a company if it exceeds one or more of the thresholds specified in the column that corresponds to the investor’s ownership interest in the company.

A common past practice to address an investor’s potential control position over another company based upon the three prongs mentioned above has been for the FRS to obtain passivity commitments from the investor. Given the objective measurements under the new control rule, the FRS does not intend to routinely obtain these standard passivity commitments going forward. Furthermore, investor companies that have already provided the standard passivity commitments may contact their local Reserve Bank to seek termination of these commitments. The FRS does not expect to revisit investor structures that have previously been reviewed unless the structures have materially changed since the original review.

This final rule applies to issues of potential control under the BHC Act and HOLA. It does not extend to questions of control under the Change in Bank Control Act (CIBCA). Thus, an investor may have a notice filing requirement under CIBCA even if it is not in a control position under the BHC Act or HOLA.

We encourage potential investor companies to review the three-pronged test before making investments that could trigger a presumption of control. If such investments would involve holding companies located in the Ninth Federal Reserve District, and there are questions regarding applicability of this new control rule, please contact Reserve Bank Mergers & Acquisitions staff by telephone or at MA@mpls.frb.org.

Mike Scott is Senior M&A Analyst with the Federal Reserve Bank of Minneapolis.